Dasco Strategy

• Проведение анализа на основе Data driven-подхода

• Разработка стратегических документов, дорожных карт

• Функциональный анализ и оптимизация процессов

• Построение эффективных систем управления и бизнес-моделей

Dasco Technology

• IT-консалтинг

• Разработка заказного ПО любого уровня сложности

• Внедрение и техническая поддержка продуктов SAP

Dasco Capital

• Управление инвестициями в высокотехнологичные компании

• Проведение исследований и анализ инвестиционных возможностей

• Поддержка в организации финансирования

• Управление активами: Private Equity & Venture Capital

• Сопровождение сделок M&A путём оценки рисков и потенциала

Как изменится современный маркетинг?

Как искусственный интеллект помогает медицине и бизнесу?

«Любой зарубежной доктрине всегда требуется местный врач»

Что ждет «чистую энергию» в ближайшее десятилетие?

Чем уникален новый экономический кризис? Отвечает Кеннет Рогофф

Почему Big Tech бьет рекорды, но опасается будущего?

Надо или не надо открывать свой бизнес?

Как повысить уровень образования в колледжах?

Почему удалённый формат не влияет на качество проектов?

Почему банки не выживут без финтеха?

Почему люди скучают в «правильных» городах?

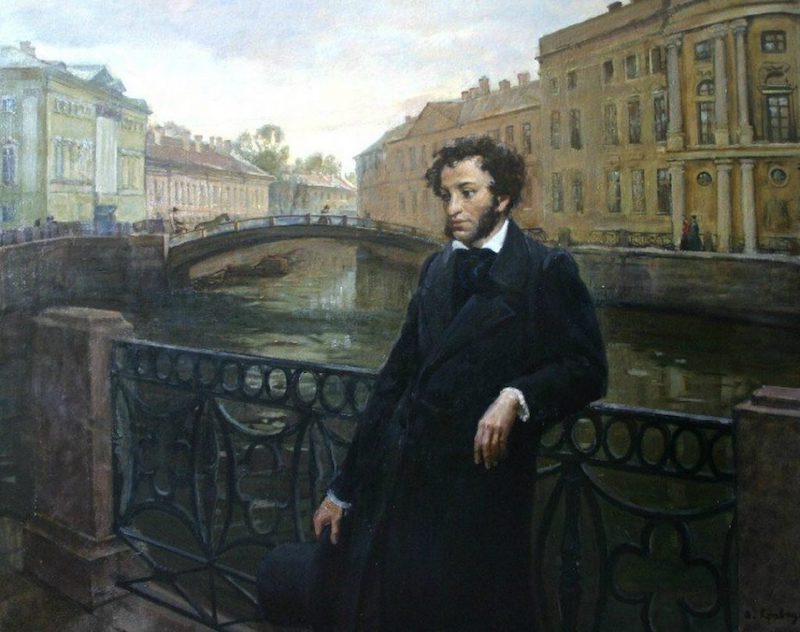

Почему обанкротился Пушкин?

Сколько платят за идею?

Почему люди перестали работать за еду?

Таможенные проверки: Как бизнес может минимизировать риски

Пройдите опрос на Survey Dasco

Мы создали аналитическую платформу для отслеживания тенденций развития казахстанского рынка. Вы можете пройти опрос и внести вклад в анализ текущего состояния экономики.

Нас рекомендуют